The company that I have been using is called Chip. It is an automatic savings app. Chip uses artificial intelligence to workout out how much money you can put away every few days. The app is growing with over 300,000 savers using its smart saving feature to save for various things such as:

- A car

- Holiday

- Wedding

- Other major purchases

Paying for these things in cash will help you to stay out of debt, control your finances and improve your budgeting. In addition to this, being in debt is what stops you from investing in your future and the interest charged on debt makes it a difficult cycle to break from.

Setting up the app

The Chip app is supported for both Android and IOS. Installation of the app is very easy and straight forward. Once installed, you can connect it to your bank. All major UK banks are supported and it is usually done in under 60 seconds. You need to be 18 and the only banks not supported are (Metro Bank, Tesco Bank, Co-Operative Bank). The app will ask for your name, card details which can be manually entered or you can take a pic using your phone.

The next stage will set-up open banking connection which is where Chip will securely take you to your online banking app, get you to login and approve the Chip app. The open banking is needed to enable the AI to decide how much money you can put away once it starts learning about your spending habits. The process is safe and secure as everything is encrypted. If you are wondering if you can use a credit card then the answer is no. Only debit cards are allowed and Chip is a closed loop which means that your money can ever only go between your bank account and Chip.

Automatic savings level

The Chip app allows you to save money automatically by letting you select the speed you want to save money. The levels will allow you to save money slowly or go at full speed. Once you have selected the level, leave it for a couple of weeks to do its magic. If you notice that you can save more then adjust the level accordingly. You can see from my example, initially, I was saving a small amount and then over time, due to my bank balance it started to save much more.

Track your progress

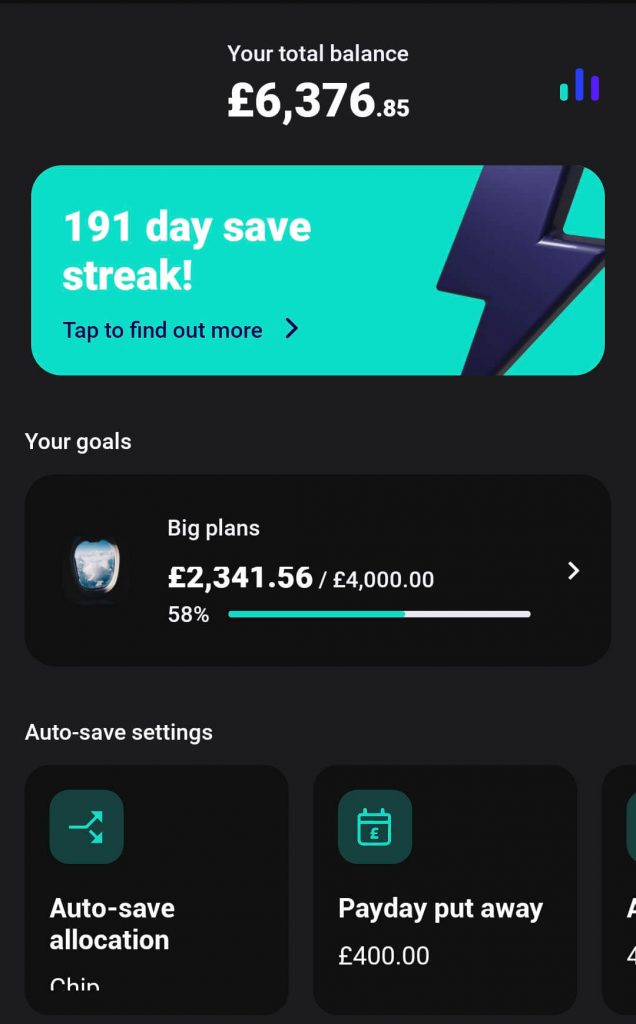

Chip creates a chart to show your progress over time which is really handy to see how much money you have been saving each month. You can then identify certain months and see if you were spending more money. In addition to this, Chip allows you to put money away on payday. You can set any amount, in the example that I have provided, you can see £400 is being put away at the end of each month.

Cost

Chip has two versions, ChipLite and ChipAI. The ChipLite is free and lets you save £100 using the autosave before you have to pay. You can continue using it by doing manual deposits.

Interest

The ChipAI allows autosave to be enabled, you can set lots of smart saving rules such as not allowing your bank balance to fall before a certain amount. You can also earn up to 1.25% interest in the Chip+1 account on funds up to £5,000. This is subject to eligibility.

Chip is introducing new features such as the ability to invest in funds and this is something I will cover in more detail in the future. I feel that fees might be an area to focus on here. Finally, Chip is regulated by the Financial Conducts Authority and the FSCS gives you the protection of up to £85,000.

My Chip account

I have added some images below to show you my current Chip account and how much I have saved.

If you have any questions or if you would like to add something, please add it to the comments.

Links:

Youtube: YouTube Channel

When you have saved enough money, check to see how you can make use of a Lifetime ISA HERE.

Correct as of 02 March 2021.

Leave a Reply