1. Create a budget

When I was growing up, I didn’t know anything about budgeting. I was always told to not buy expensive things but never how to track, save or invest my money. A budget is such an important part of managing your money because it instills good habits, from a young age, such as not spending money you don’t have, living within your means and not getting into credit card debt. A budget doesn’t have to be overly complicated and it can simply track money that is coming in from part-time job or pocket-money and monitoring where that money is being spent to ensure at the end of each month you are saving 20-30 percent. In some cases, it might help shed light on bad spending habits that can be rectified early on.

It might not be fun as a young person to keep track of your finances but it would definitely help you understand what you can afford, how much you have saved and it can put you years ahead of your peers. Today, there are many apps that can help and support with budgeting as well as saving such as Yolt, Emma, Chip and Mint. These apps simplify the process which means you are more likely to stick to a budget.

2. Emergency savings

Dave Ramsey, an American personal finance advisor, has studied many millionaires and he has highlighted many times the importance of an emergency fund. During my teenage years, I didn’t really have any emergency savings, only a small amount of money saved that I would use to buy unnecessary things. I guess at the time I didn’t need one as my parents were paying for the bills however as an adult, I now realise how important it is to have an emergency fund. It can pay for many unexpected things such as car repair, emergency home repairs or helping family out financially. During this lockdown, it has made a huge difference and has provided a cushion.

Most financial planners recommend 6 months but during times of uncertainty I feel 9 months is more appropriate and the money could be stored in a high interest savings account such as Chip+1. If you have not used Chip then I will put a link to that video on here. Having this in place means you don’t need to sell any investments which can have a huge impact on your overall returns.

3. Investing early and regularly

Starting your investing journey early is the secret to wealth. There is a famous quote by Albert Einstein whereby he says that “Compound interest is the eighth wonder of the world. He, who understands it, earns it…he who doesn’t….pays it.” What Einstein was suggesting is that compound interest can either work for you or against you. The choice is yours. People often think that long term is 10 years but for this to truly work you need to give it 20 years or more. The initial amount that you start with also makes a huge difference. I started to invest in 2015, so that is 6 years ago when I was 21. I invested £7,600 which was an amount I had saved from my part-time job and I had that money sitting in my account, doing nothing, for over three years. It was only around August 2018 I set-up a monthly regular investing, meaning I missed out on 3 years of regular investing and compounding. If I didn’t make further contributions to the initial amount, this amount with be equal to £11,405 @ 7%. This is without taking fees into this calculation.

If I had invested 3 years earlier, the amount would be £13,972. A difference of £2,567. Now this may not seem a lot but over decades would make a huge difference. It would also mean, to achieve the same amount, I would need to have £9,310 invested at the age 21 to catch-up with the previous investment. An increase of £1,710 due to time. The earlier you start, the less capital you have to put in.

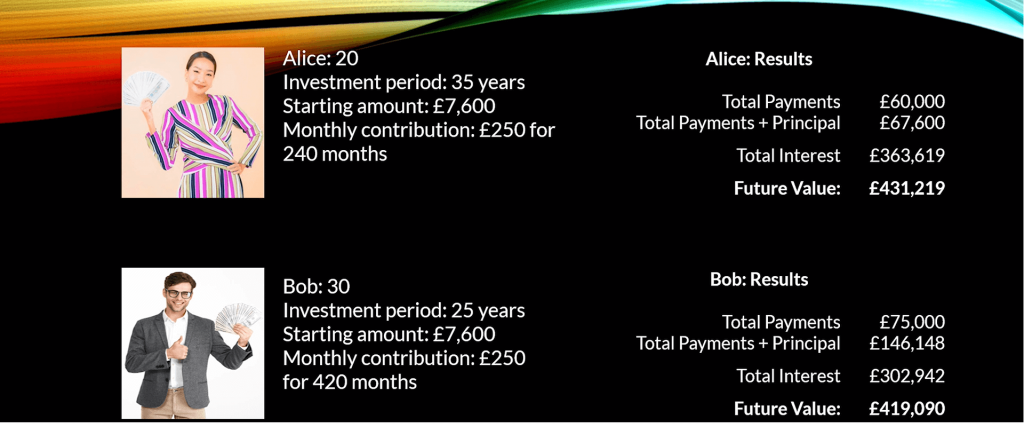

You can see an example where we have two people, Bob (30) and Alice (20). Alice will invest for the next 35 years however Bob keeps his money in the bank for the first 10 years and then invests it for the next 25 years. For illustrative purposes, I have used 1.5% interest that Bob will receive for the first 10 years and I have kept the monthly contribution the same for both. Alice and Bob are both starting with an initial amount of £7,600. Alice starts investing when she is 20 and for the next 20 years, she regularly adds £250 a month and then stops her regular contribution for the last 15 years. Bob, on the other hand continues making monthly contributions throughout the 35 year period.

*In the end Alice makes a total payment + principal amount of £67,600 which has a future value of £431,219 compared to Bob who has payment + principal amount of £146,148 and a future value of £419,090. You can see Alice’s portfolio is valued £12,129 higher than Bob’s and in that period she also invests £78,548 less than Bob. The earlier you start, the less you have to contribute and if Bob was to start investing in his 40s, he would need to invest far more money to catch-up with Alice.

4. Reading books related to investing

When I was growing up one thing I didn’t do was read books related to finance. There are so many books out there with timeless principles on saving and investing. I wish I came across some of these books earlier in my life such as the “Richest man in Babylon” which highlights the importance of saving 10 percent of everything you earn, paying yourself first and not confusing expenses with desires. The book mentions something really valuable about improving your skills because wealth is the result of a steady income. In addition, there are so many other excellent advice given such as surrounding yourself with people familiar with money, being cautious who you take advice from i.e. only use experts in the field of finance and don’t spend your money as soon as you earn in. I think the one thing I try to remember from the book is to also enjoy life whilst you are here and don’t overstrain yourself in order to save everything.

Debt is also a topic covered and the advice given is to pay debt with the smallest first, focusing on those with the highest interest as well. Other books I wish I had come across when I was young are Rich dad poor dad and the millionaire next door.

5. Starting a SIPP account.

The first time I came across a pension was when I first started my job as a web developer. If I could start again, I would get my parents to open a Junior SIPP pension at the age of 16 or even younger. They could then contribute money into that account and the government would add a 25% bonus. For example, the maximum amount that could be added is £240 a month which gives an annual limit of £2,880. When the relief is added, the sum rises to £300 month, an uplift of £60 per month, which will give you a final amount of £3,600 per year. The bonus makes a huge difference and over the time compounding will also take place. The limitation with this type of account is that you can only withdraw money from the age of 57. On the plus side, you are planning for your child’s future and giving them a head start. It means once they reach the age of 30, they don’t have to contribute a lot of money and they can still end up with a really healthy pension. The key thing here is time and the difference it can make.

- “illustrative purpose only. Past performance not an indication of future performance”

Leave a Reply